vivat worldwide

Our Investment Management team is currently managing a portfolio of real estate assets composed of branded European 5-star hotels and a mixed-use and entertainment complex. The assets under management represent a value of over US$500 million. Some of these assets VIVAT sourced and managed the acquisition of the real property and holding company through either Sale and Purchase Agreement or Share Transfer Agreement. Other of these assets were managed through ground-up investment and development, requiring high-level government authority engagement and negotiation, strategy, and execution.

-

Paris Pullman La Defense

The Pullman Paris La Défense Hotel is a 382-room 5-star hotel located in the heart of La Défense, the financial district of Paris. VIVAT sourced a high-profile luxury hotel property in a central location in Paris. The acquisition consisted of shareholder takeover of the principal holding company.

Under VIVAT management, the operations mitigated a severe market downturn achieving above-market returns in that period, and through strategic investments, VIVAT has enhanced the asset future value for greater returns to the Client.

-

Barcelona Renaissance Hotel

Renaissance Barcelona Hotel. VIVAT sourced a high-profile luxury hotel property in a central location in major cities in Spain. Through negotiation was able to achieve favorable terms for the acquisition of the Real Property and Operating Business. Under VIVAT management, the operations mitigated a market downturn achieving above market returns in that period, and through strategic investments, VIVAT has enhanced the asset future value for greater returns to the Client.

-

Toronto Embassy Suites

Embassy Suites Niagara Falls. For this ‘best in class’ hotel investment in Ontario, Vivat provided hospitality due diligence and acquisition management services to its Client.

-

Paris Courtyard

Paris Courtyard. Vivat with its longstanding business relationship with Marriott International was able to provide to one of its Clients; an “Investment Fund” with a unique investment opportunity.

-

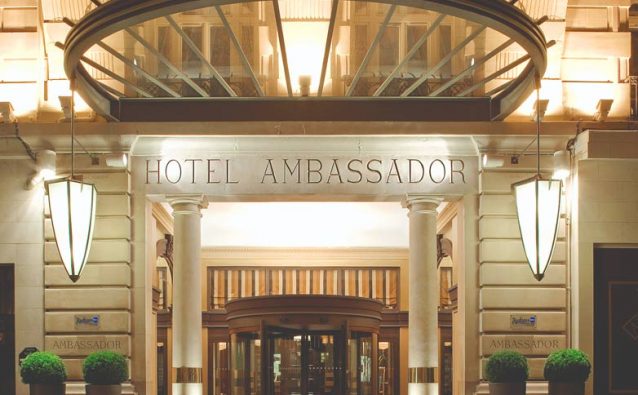

Paris Radisson Blu

Radisson Blu Ambassador Hotel. For this investment project, Vivat provided market survey, legal services, due diligence study, and valuation services to its Client.

-

Athens

Through Vivat’s extensive network of contacts throughout Europe, Vivat was able to source for its Client a unique and exiting Investment opportunity at a Hilton Athens 5 star luxury hotel. Vivat managed the evaluation of the property and estimated the potential revenue and value of the property on

numerous renovation and rebranding scenarios. This helped the Investor prepare their purchase offer and negotiate the sale on advantageous financing terms.

-

London Hilton Wembley

For the Hilton Wembley investment, Vivat provided hospitality due diligence and acquisition management services to its Client.

-

Paris Pullman La Defense

The Pullman Paris La Défense Hotel is a 382-room 5-star hotel located in the heart of La Défense, the financial district of Paris. VIVAT sourced a high-profile luxury hotel property in a central location in Paris. The acquisition consisted of shareholder takeover of the principal holding company.

Under VIVAT management, the operations mitigated a severe market downturn achieving above-market returns in that period, and through strategic investments, VIVAT has enhanced the asset future value for greater returns to the Client.

-

Barcelona Renaissance Hotel

Renaissance Barcelona Hotel. VIVAT sourced a high-profile luxury hotel property in a central location in major cities in Spain. Through negotiation was able to achieve favorable terms for the acquisition of the Real Property and Operating Business. Under VIVAT management, the operations mitigated a market downturn achieving above market returns in that period, and through strategic investments, VIVAT has enhanced the asset future value for greater returns to the Client.

-

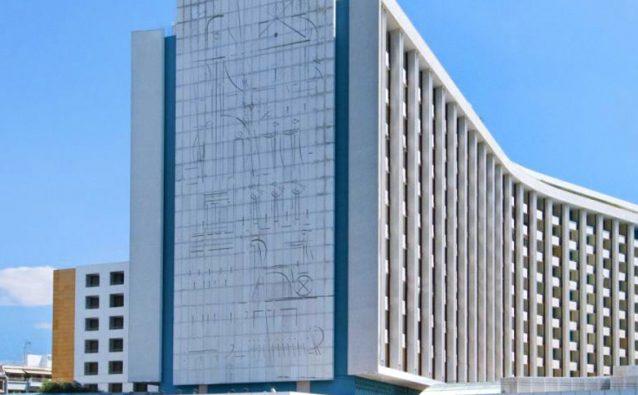

Minsk

In 2011 Vivat was appointed to fully developed a US$300 million project in Minsk including a 5-star Hotel and a sport and entertainment Complex.

Our Company brokered land development rights for the Complex in Minsk with Belarusian top-level government officials and managed the investment and real estate development including securing hotel licensing and project management from design through construction.

We oversaw the market study, legal and financial due diligence, feasibility studies, project planning, local company establishment and full management of ground-up development.At the post-development stage, our Company has been chosen to manage the property on behalf of the new Owner. We have established a company in Minsk in order to effectively manage the asset and operations. The Complex fully opened in February 2017.

-

Minsk

In 2011 Vivat was appointed to fully developed a US$300 million project in Minsk including a 5-star Hotel and a sport and entertainment Complex.

Our Company brokered land development rights for the Complex in Minsk with Belarusian top-level government officials and managed the investment and real estate development including securing hotel licensing and project management from design through construction.

We oversaw the market study, legal and financial due diligence, feasibility studies, project planning, local company establishment and full management of ground-up development.At the post-development stage, our Company has been chosen to manage the property on behalf of the new Owner. We have established a company in Minsk in order to effectively manage the asset and operations. The Complex fully opened in February 2017.

-

Frankfurt

Frankfurt Intercontinental Hotel. Vivat was mandated by a Client “Investment Fund” to provide investment management professional services and to undertake an extensive study based on a full evaluation of this hotel on legal, financial and engineering terms, in addition to providing procurement recommendation on how to best improve the financial performance and value of the hotel.

-

Vienna

Marriot Hotel Vienna. Vivat was mandated by a Client “Investment Fund” to modify the top floor of the Marriott Hotel in Vienna from its existing standard room arrangements into luxury suites. To that end, Vivat engaged the services of local consultants and interior decorators to design, oversee and undertake the renovations works. The project was completed below budget and within the allocated scheduled time frame.

Empty Projects